Statistics from the

Nigerian Stock Exchange for March 31st, 2019 indicates that the total market capitalization

was N11.7 trillion generated from 169 companies listed on the stock within 12

sectors. Over the years, agriculture,

construction and real estate, consumer goods, industrial goods, healthcare, information

and communications technology, natural resources and, oil and gas have been seen

the significant industries contributing to the country’s economic growth and sustainability.

Activities and expected

functions of these industries are interwoven. For instance, real estate and

construction cannot make its contribution to the Gross Domestic Product without

the support industrial goods, ICT and healthcare. As businesses continue to

innovate at process and product levels, Infoprations

has discovered that a new industry is emerging. It appears that Total Real

Estate Solutions is evolving from the stable of Alpha Mead and Facilities

Management, Nigeria’s leading FM company.

After

several months of monitoring the shapes the industry is taking, Infoprations believes that TRES is about

serving most or all the needs of a particular group of customers, signifying that

companies that deem it fit to compete in the space must position themselves

using a needs-based strategies. TRES is also about segmenting customers in different

ways.

For

example, total real estate solutions should not neglect the people at the

bottom of the pyramid, people in the rural areas. There must be inclusive

solutions not only premium solutions to the people in urban areas and upper of

the pyramid. Beyond people, TRES companies should consider businesses at lower

ebb too. Companies should not position themselves using variety-based

strategies. Solutions in TRES should not be communicated using the product or

solution varieties.

Forces

Underpinning and Constraining Existing Industries

As it is now, TRES is a

combination of real estate development, security, facilities and healthcare

management industries. The idea is to have an industry that provides aggregated

solutions for the built environment and the users, appropriating integrated

processes and solutions or products. These industries are being measured quarterly

and yearly by the National Bureau of Statistics using real estate and

construction, water supply, sewerage, waste management and remediation,

administrative and support services, human health and social services,

professional, scientific and technical services.

In our model, we

considered water supply, sewerage, waste management and remediation, and administrative

and support services as part of the facility management industry. Healthcare

management was analysed within human health and social services. However, we

did not dispute the fact that the healthcare management segment of the TRES

could also be measured within the administrative and support services,

especially when an FM company is engaged to maintain health equipment not the

entire health facility. The security aspect of the TRES was analysed employing

relevant Gross Domestic Product data within professional, scientific and

technical services. Real estate and construction were analysed differently

using individual data released by the National Bureau of Statistics.

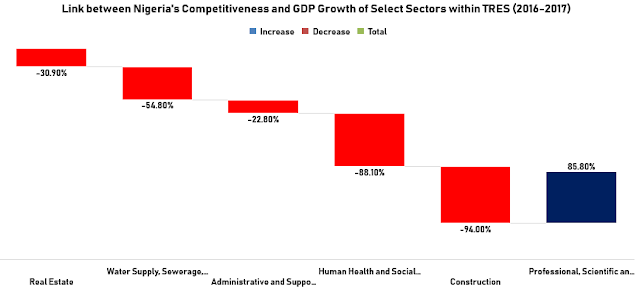

Our analysis reveals

that companies in TRES industry need to make a number of strategic moves in the

next few years, for the industry to make meaningful impacts and contribution to

the GDP. The performance of the analysed industries in the last 3 years is low

compared to international standards.

From the global

competitiveness perspective, businesses in the TRES and stakeholders need to devise

strategies and mechanisms that would help in improving efficacy of corporate boards, macroeconomic

environment, foreign competition, local competition, goods market efficiency, labour

market efficiency, financial services meeting business needs, ease of access to

loans, financial market development, availability of latest technologies, firm-level

technology absorption, local supplier quantity, local supplier quality, capacity

for innovation, spending on research and development.

This is imperative

because our analysis indicates that existing industries that TRES is leveraging

connected with these factors negatively between 2016 and 2017, signifying poor

performance at process, product or solution and technological levels. In our

analysis, we found that the higher the rankings (poor status) of these factors,

the less the contribution of the industries to the GDP growth in 2016 and 2017.

For instance, a 1 point

increase in the ranking of the factors in 2016 reduced the real estate

contribution to the GDP by 30.9%. This was dipped to 19.8% in 2017. This is an

indication that companies and governments’ efforts improved the rankings of the

factors positively in 2017. The similar

efforts were futile in 2016 and 2017 for the water supply, sewerage, waste

management and remediation. Our analysis shows that the increase in the

rankings led to 54.8% and 85.7% reduction in the contribution of the sector to

the GDP during the years.

The narrative was not

different from the administrative and support services. The sector’s

contribution was affected by 22.8% and 57% in 2016 and 2017 respectively. For

the human health and social services, the poor rankings of the factors denied

its contribution to the GDP by 88.1% in 2016 and 99% in 2017. With a 13.4%

reduction, the poor rankings only had a mild impact on the construction sector

in 2017. The impact was 94% in 2016. The 2016’s reduction attained by the

construction sector was surged by 0.8% for the professional, scientific and

technical services sector in 2017. The rankings affected the sector’s

contribution by 94.8% during the year. In 2016, 85.8% was recorded for the

sector, our analysis reveals.

Link among the GDP growth of the

select sectors

Since the real estate

is the base of the total real estate solution, we carried connection analysis

of the previous performance of the industries TRES is leveraging. From the

analysis, it is clear that real estate linked with construction and

professional, scientific and technical services positively, while negative

connection was recorded in the other three sectors. A one percent increase in

the contribution of real estate to the GDP between 2016 and 2018 led to 11.1%

increase in the contribution of the construction sector to the GDP.

Over 10% increase in

the contribution of professional, scientific and technical services was found

when real estate contribution was at 1%. For the water supply, sewerage, waste

management and remediation, a 1.6% reduction in its contribution was discovered

when real estate had 1% contribution to the GDP. It was a 92.2% reduction in administrative and

support services sector when real estate attained 1% contribution. One percent

contribution of the real estate was also discovered as 30.5% reduction in the

contribution of the human health and social services to the GDP.

From the insights, it

is obvious that TRES performance would largely depend on the extent to which

companies and stakeholders exploit opportunities in real estate, construction

and professional, scientific and technical services. As an emerging industry,

TRES is also likely to have proper shape when the weaknesses and threats in

other sectors are eliminated using appropriate strategies.

For instance, efforts

should be made to remove clogs within the market fundamentals, performance

measurement, regulatory and legal, transaction process and sustainability in

the real estate sector to make the sector highly transparent. This is necessary

based on the fact that the country’s poor ranking in the global

real estate transparency index affected the real estate sector’s

contribution to the GDP by 13.5% between 2016 and 2018.

Critical

Capabilities Transferring (CCT)

Companies with

integrated solutions in each of the industries that form TRES have a better

chance of winning in TRES space, our analysis suggests. In this regard, Alpha

Mead’s rapid turnaround, in terms of strategic business unit with vertical

integration that allows the combination of existing resources towards

sustainable value delivery, is essential to its cost reduction and effective operational

efficiency in the new space.

Comments

Post a Comment